Unilever’s Strategies for Competing in Foreign Markets

Unilever Group: Cosmetics and Toiletries Business

This paper was published on Strategic Management seminar. By : Muhammad Fikri, STP, MBA Corporate Credit Analyst PT Bank Negara Indonesia (Persero) Tbk Email : m.vickry@gmail.com Phone : +62 813 2804 3661PAPER’S SUMMARY

As one of the strong and healthy companies in the world with many successful brands, Unilever has an opportunity to expand into foreign markets in order to gain access to customers around the world. Supported by strengths of its four key global brands – Dove, Sunsilk, Rexona and Lux, Unilever firstly entered in foreign market to compete internationally by entering just one or select few foreign markets. Once successfully introduced its product in several market, Unilever expands its success brand to many other markets and starting to compete globally.

As one of the strong and healthy companies in the world with many successful brands, Unilever has an opportunity to expand into foreign markets in order to gain access to customers around the world. Supported by strengths of its four key global brands – Dove, Sunsilk, Rexona and Lux, Unilever firstly entered in foreign market to compete internationally by entering just one or select few foreign markets. Once successfully introduced its product in several market, Unilever expands its success brand to many other markets and starting to compete globally.

In entering and competing in foreign markets for its cosmetics and toiletries product, Unilever follows a global strategy, also called by a think-global and act-global strategy, The strategy using essentially the same competitive strategy approach in all country markets where the company has a presence (with only minimal responsive to local conditions), sells much the same products everywhere (make minor adaption to local countries where needed to accommodate local countries preferences), strives to build global brands, and coordinates its actions worldwide (centralized). A global strategy used by the Unilever is preferable to localized strategies because Unilever can more unify its operations and focus on establishing a brand image and reputation that is uniform from country to country. It strategy implies to the Unilever success in building strong character brand such as Dove, Sunsilk, Rexona and Lux. Moreover, with a global strategy Unilever should coordinated its marketing, operational and distribution worldwide.

Unilever is increasing its efforts to build on its long-established local roots in developing regions. Through its well-established distribution network in both the traditional and modern retail outlets and with a good ability to adapt successful global brand concepts to suit local markets, Unilever is in a good position to be able to capitalize on the growth forecast in these regions.

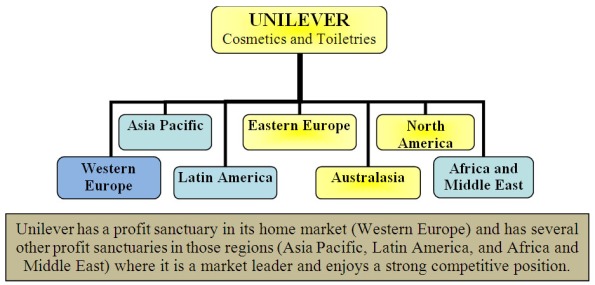

Once Unilever became one of the most successful global companies in the world, it has many profit sanctuaries. By having multiple profit sanctuaries, Unilever has strong competitive advantage over its competitor with a single or few sanctuaries. In the cosmetics and toiletries globally competitive industry, there are no doubt that Unilever’s major rivals over the next few years will be Procter & Gamble and L’Oréal, both of which give significant resources to new product development activity, and respond to changes in the market faster than Unilever. L’Oréal also has the benefit of being exclusively involved in cosmetics and toiletries, unlike both Unilever and Procter & Gamble which both have cross-industry involvement, such as in packaged food. Much the same group of rival companies competes in many different countries. Therefore, the competition pursues the company to be more innovative in developing its products and maintaining its brands.

To win customers and sales away from select rivals in country markets, Unilever employ cross-market subsidization. This offensive strategy is appropriate for Unilever which is compete in multiple county markets with multiple brands and wide variety of products. Finally in entering the emerging-country market Unilever prepare to compete on the basis of low prices. Unilever pursued this strategy because consumers in emerging markets are often highly focused on price, which can give low-cost local competitors the edge unless a company can find ways to attract buyers with bargain prices as well as better products.

All strategies executed by Unilever for competing in foreign market resulting in moderate 5% sales growth in 2006 – just above market performance – ensured that Unilever kept its position as third largest player in cosmetics and toiletries with a 7% market share. Second-placed L’Oréal fared a lot better, increasing the gap between the two companies in part thanks to its acquisition of The Body Shop. Market leader Procter & Gamble remained over five percentage points ahead of Unilever’s share. In 2006, Unilever remained comfortably ahead of Colgate-Palmolive in fourth place. Unilever decision to introduce its product on emerging market such as Asia-Pacific, Latin America and North America implies to the high contribution of Unilever total revenue by 26%, 21% and 16% respectively.

——————————————————-

COMPANY BACKGROUND

In the 1890s, William Hesketh Lever, founder of Lever Bros and later Lord Leverhulme, wrote down his ideas for Sunlight Soap – his revolutionary new product that helped popularize cleanliness and hygiene in Victorian England. “It was toward make cleanliness commonplace; to lessen work for women; to foster health and contribute to personal attractiveness, that life may be more enjoyable and rewarding for the people who use our products (Unilever Company Website, 2008)”.

Founded in 1930 and based in United Kingdom, Unilever is one of the world’s leading suppliers of fast moving consumer goods across Foods and Home and Personal Care categories. Unilever’s portfolio includes some of the world’s best known and most loved brands. The group operates worldwide and employs 174,000 people in 316 companies by the time of writing (Unilever Financial Report, 2008).

Since it was founded, Unilever established new business in several countries, such as United Kingdom, Germany, Spain, USA, Argentina, Turkey, Netherlands, Canada, China, South Africa, Italy, Sweden, Brazil, Russia, and Czech Republic and operated its own production factory in 158 strategic locations in those countries. For competing in foreign market, Unilever owned 316 subsidiaries worldwide and until 2008, Unilever has launched about 900 different brands. Several key facts of Unilever Group can be shown in the Table1 below.

Unilever Group: Key Facts

The Unilever Group manufactures a wide range of consumer products including packaged food, weight management products, personal and household care. It splits its business activities into two divisions, Foods and Home & Personal Care: the cosmetics and toiletries business comes under the Personal Care subdivision, its largest in terms of revenue generation.

The diversity of Unilever’s cosmetics and toiletries portfolio, which encompasses some of the world’s leading brands such as Rexona, Dove and Axe/Lynx/Ego, contributes to its success in the global market. The company also owns a number of successful regional brands such as Lifebuoy. In recent years Unilever has increasingly turned to focus on strengthening its position in the mass market.

Unilever ranked third in the global cosmetics and toiletries market in 2006, with a share of 7%. The company has a strong global presence, with Western Europe, Latin America and Asia-Pacific as its key markets. Over the review period, the company has also increased its sales in many other developing regions including Latin America and Africa and the Middle East. Latin America overtook North America as the third largest market for Unilever in 2005 and continued growing in 2006.

Unilever mission and corporate purpose

Unilever’s mission is to add Vitality to life. “We meet everyday needs for nutrition, hygiene and personal care with brands that help people feel good, look good and get more out of life.”

Unilever deep roots in local cultures and markets around the world give the company’s strong relationship with consumers and are the foundation for the company’s future growth.

“We will bring our wealth of knowledge and international expertise to the service of local consumers – a truly multi-local multinational. Our long-term success requires a total commitment to exceptional standards of performance and productivity, to working together effectively, and to a willingness to embrace new ideas and learn continuously. To succeed also requires, we believe, the highest standards of corporate behavior towards everyone we work with, the communities we touch, and the environment on which we have an impact. This is our road to sustainable, profitable growth, creating long-term value for our shareholders, our people, and our business partners” (Unilever financial report, 2007).

Difficult market conditions have prompted Unilever to embark on a major restructuring program including a switch from brand management to sectoral management. The new company structure, under the “One Unilever” name, consists of streamlining the organization and management of its products in each market, combining the sales teams for the Foods and Home & Personal Care divisions in order to present a united front for the company and leverage its scale. The strategy is expected to deliver EUR 700 million in savings and a further EUR 1 billion in extra income by the end of 2007.

ANALYSIS

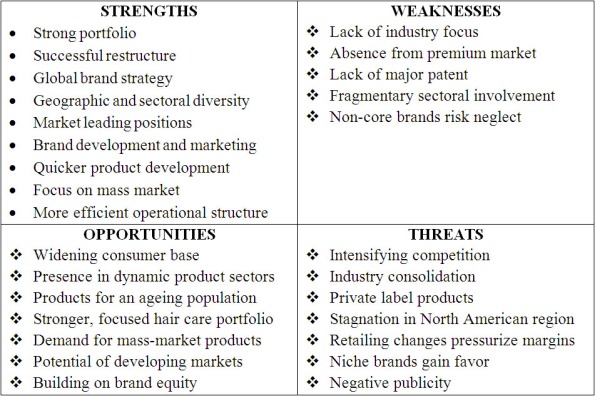

Before analyzing the Unilever strategies for competing in foreign market, it’s important for us to identify company’s resource strengths and weaknesses and its external opportunities and threats, commonly known as SWOT analysis. This analysis provides a good overview of whether the company’s overall situation is fundamentally healthy or unhealthy. Therefore, for a company’s strategy to be well-conceived, it must be:

– Matched to its resource strengths and weaknesses – Aimed at capturing its best market opportunities and erecting defenses against external threats to its well-beingSWOT Analysis of Unilever Cosmetics and Toiletries

Unilever’s Strengths

v Strong portfolio – Unilever has an extensive portfolio of cosmetics and toiletries products, owning some of the world’s leading brands, including Dove, Sunsilk, Rexona and Axe/Lynx/Ego. Through a successful brand diversification strategy, these brands have been extended into new fast-growing sectors, which has helped strengthen the image of its world-leading brands.

v Successful restructure – the ongoing implementation of Unilever’s “One Unilever” restructuring programme including a switch from brand management to sectoral management seems to be working. This move should free up additional funds to invest in existing brands.

v Global brand strategy – Unilever’s focus on building core global brands is in keeping with the current trend in global consumables marketing, which stands it in good stead against its multinational competitors.

v Geographic and sectoral diversity – the company has a wide global presence, allowing it to benefit from growth markets, which helps to offset maturity in others. Similarly, the company’s diverse portfolio, spread across a range of cosmetics and toiletries sectors and geographical markets, acts as a cushion against market contraction in one particular area.

v Market leading positions – Unilever is the leading bath and shower products and deodorants marketer in the world, as well as in its domestic Western Europe, Eastern Europe, Latin America and Africa and the Middle East. The successful launch of Axe in North America in 2003 has significantly improved the company’s standing in the important North American men’s grooming products sector.

v Brand development and marketing – Unilever is very advanced in its advertising and marketing program and very active in in-store displays, which is a must for success in cosmetics and toiletries. In many of Unilever’s largest sectors, the company’s wide presence has been built on successful product innovation with the timely introduction of brand extensions well suited to changing consumer preferences.

v Quicker product development – efforts are underway to shorten the time spent rolling out new products, which will contribute towards Unilever increasing its flexibility to respond to changing consumer demands and keep ahead of the competition.

v Focus on mass market – the sale of its premium beauty business to Coty in May 2005 will allow Unilever to concentrate on strengthening its position in the mass market.

v More efficient operational structure – changes to Unilever’s internal structure, with increasingly centralized and globally-managed divisions, have led to increasing synergies within the business, such as in its distribution activities. Ongoing restructuring will further reduce operating costs across the company.

Unilever’s Weaknesses

v Lack of industry focus – the diversity of Unilever’s overall portfolio, which includes packaged food and household care products, means that cosmetics and toiletries may not get the resources it needs when a sudden change in demand happens, and also may impede the speed at which new products get to market.

v Absence from premium market – the company has focused on the mass-market channel with the sale of its prestige beauty business to Coty in May 2005. This rule out the opportunity for the company to benefit from the growing trend towards premiumization.

v Lack of major patent – although Dove’s 25% moisturizing ingredients content is a strong selling point, Unilever does not own a significant patent such as those owned by rivals L’Oreal and Procter & Gamble, which respectively own Dermo-Expertise ReFinish Micro-Dermabrasion and Pantene Pro-V’s pro-vitamin B complex technology.

v Fragmentary sectoral involvement – the company is involved in several non-core cosmetics and toiletries sectors, namely sun care, baby care and color cosmetics, which do not bring in enough revenue to warrant their position in Unilever’s portfolio in light of its current focus on core brands.

v Non-core brands risk neglect – focus on its six core brands means that smaller brands and other product sectors are in danger of being overlooked in terms of marketing support.

Unilever’s Opportunities

v Widening consumer base – Unilever is attracting a wider consumer base through the expansion of its brands and geographic markets. This is particularly significant in the increase in products designed specifically for men, such as Rexona for Men and Axe, whilst Lynx in the UK has proved particularly popular with younger males in the 17-34 age groups. The ongoing growth of men’s grooming products is likely to bear further positive results for the company’s activities in this sector.

v Presence in dynamic product sectors – the company’s involvement in sectors such as sun care and baby care, though currently small, gives Unilever the potential to benefit from these fast-growing sectors in the future.

v Products for an ageing population – Unilever will continue to benefit from the world’s changing demographics, with nourishers/anti-agers and firming skin care products becoming increasingly popular as the number of mature women grows as well as their spending power. With a strong presence in both face care and body care, the company is in a strong position to capitalize from this trend.

v Stronger, focused hair care portfolio – the simultaneous divestment of Aqua Net and Finesse, and the global roll-out of Sunsilk shampoo and conditioner, as well as new formulations for Suave and Dove in hair care, will help Unilever exploit strong growth anticipated in hair care over the 2006-2011 period.

v Demand for mass-market products – growing global urbanization will continue to drive demand for products in the mass market, such as those provided by Unilever.

v Potential of developing markets – Latin America, one of Unilever’s key markets, is in full expansion and is expected to remain one of the most dynamic in cosmetics and toiletries over the forecast period (over 3% CAGR, 2006-2011, +US$6.7 billion). It is also the region in which the company’s product mix is the most diverse and includes high growth sectors, thus representing a great potential for global market share gain. Unilever is also well positioned to benefit from the growth in other emerging markets, such as Eastern Europe, Asia-Pacific and Africa and the Middle East, where growth in cosmetics and toiletries sales is generally expected to outstrip that of the global market.

v Building on brand equity – a recent survey in the UK revealed several Unilever brands to be amongst the most trusted as far as UK consumers are concerned. Ongoing corporate branding activity should help drive this message further across all Unilever’s areas of interest.

Unilever’s Threats

v Intensifying competition – competition is rising on various fronts. Procter & Gamble’s 2005 acquisition of Gillette and Henkel’s acquisition of Right Guard, Soft & Dri, Dry Idea and Dial in February 2006 from the former Gillette Company are the latest developments in a marked intensification of competition among the leading players in cosmetics and toiletries, particularly in men’s grooming products, threatening the brand share of Unilever’s Axe, Rexona and Dove men’s products.

v Industry consolidation – Unilever is at constant risk from further consolidation within the industry, which threatens its market position in a number of sectors.

v Private label products – as a supplier to the mass-market retail channel, Unilever is at risk from an increase in the production of increasingly sophisticated and low-priced private label products through large retailers.

v Stagnation in North American region – a challenging environment remains in North America, which has seen only sluggish interest in cosmetics and toiletries, as a result of the slow economy. This continues to threaten net sales and profits in this market.

v Retailing changes pressurize margins – in the US mass market in particular, the rise of dollar stores and discounters such as Wal-Mart is increasing sales of discounted cosmetics and toiletries products which may well have a negative impact on operating margins, as well as reducing demand for higher-priced products.

v Niche brands gain favor – the growing popularity of small niche brands in markets such as the UK may well have a negative impact on the sales and market share of multinational brands, including Dove.

v Negative publicity – despite stating that it is exploring ways of testing its products in different ways than on animals, Unilever has not completely stopped the use of animal testing. This leaves it open to consumer boycott, as well as action by animal rights activists, which may interrupt its business.

Based on the SWOT analysis we can infer that the company has very healthy and strong condition in overall. Therefore, this condition provides high capabilities to the company and offers wide opportunities for the company to compete in foreign market. Based on Table 2, Unilever firstly entered foreign market in the year of 1950 by offering its product to European community.

From the unilever mission statement, we can conclude that the company expands into foreign markets in order to gain access to customers around the world. Unilever recognized that its product is commonly used for all people worldwide. The company’s objective to bring their wealth of knowledge and international expertise to the service of local consumer pursues the company to produce many nutrition, hygiene and personal care product with successful brands. Therefore, Unilever are moving rapidly and aggressively to extend their market reach into all corners of the world.

For its cosmetics and toiletries product, Unilever start to compete internationally by entering just one or select few foreign markets. Based on the Table2, we can notice that Unilever launches Axe/Lynx/Ego deodorant body spray in the US and Canada in autumn 2002 and introduced Dove initially in Italy, France and Belgium in 2002. Once successfully introduced its product in several market, Unilever expands its successful brand to many other markets and starting to compete globally.

Through its successful growth strategy, Unilever has continued to build on the strengths of its four key global brands–Dove, Sunsilk, Rexona and Lux–and by doing so, created strong platforms for further growth in a number of cosmetics and toiletries sectors. This has been particularly evident in deodorants, men’s grooming products and bath and shower products, with strong growth for the Axe, Dove and Rexona brands. However, competition in the cosmetics and toiletries industry remains tough, and while the current strategy is providing results, greater product innovation and marketing support, as well as further development of functionality in products will be needed to keep up with the market. There are no doubt that Unilever’s major rivals over the next few years will be Procter & Gamble and L’Oréal, both of which give significant resources to new product development activity, and respond to changes in the market faster than Unilever. L’Oréal also has the benefit of being exclusively involved in cosmetics and toiletries, unlike both Unilever and Procter & Gamble which both have cross-industry involvement, such as in packaged food.

In a globally competitive industry faced by Unilever, much the same group of rival companies such as Procter & Gamble and L’Oréal competes in many different countries, but especially so in countries where sales volumes are large and where having a competitive presence is strategically important to building a strong global position in the industry. Therefore, a company’s competitive position in one country both affects and is affected by its position in other countries. In this case innovation plays an important role. Thus, in a market where innovation is often the key to growth, Unilever has invested in improving its research and developing procedure further including speeding up the process of getting new products to market. Through a mass-market positioning, much of the company’s organic growth strategy is to leverage the value of key brands by cross-sectoral brand extensions, thus taking advantage of customer brand recognition and loyalty, and creating marketing efficiencies. The Dove brand is one of the examples of a recognized soap brand being successfully extended into skin and hair care, deodorants, baby care and men’s grooming products.

In entering and competing in foreign markets for its cosmetics and toiletries product, Unilever follows a global strategy, using essentially the same competitive strategy approach in all country markets where the company has a presence, sells much the same products everywhere, strives to build global brands, and coordinates its actions worldwide. This strategy also called by a think-global and act-global strategy. It has theme to prompt Unilever managers to integrate and coordinate the company’s strategic moves worldwide and to expand into most if not all nations where there is significant buyer demand. It puts considerable strategic emphasis on building a global brand name and aggressively pursuing opportunities to transfer ideas, new products and capabilities from one country to another.

Since country-to-country differences in toiletries product are small enough to be accommodated within the framework of a global strategy, a global strategy used by the Unilever is preferable to localized strategies because Unilever can more unify its operations and focus on establishing a brand image and reputation that is uniform from country to country. It strategy implies to the Unilever success in building strong character brand such as Dove, Sunsilk, Rexona and Lux. Moreover, with a global strategy Unilever should coordinated its marketing, operational and distribution worldwide.

Unilever’s marketing strategy for competing in foreign market

For its marketing strategy Unilever combines its strategy with social project in many countries. Educational campaigns have been important tools for raising awareness for Unilever brands such as Close-Up and Dove. The company’s partnership with the World Dental Federation has seen it become involved in oral healthcare projects in both developed and emerging nations, including Austria and Brazil. In 2006, Unilever developed a low-cost toothbrush, the Pepsodent Fighter, which retails at a price equivalent to just EUR0.20 and is distributed in India and Indonesia.

The company also has more directly brand-related programs, including Close-Up’s Project Smile in Nigeria, which used small kiosk outlets to showcase both its products and oral hygiene information, and the Dove Self-Esteem Fund, which has joined with organizations such as the Girl Scouts of the USA and the UK’s Eating Disorder Association to fund educational Body Talk programs in schools to improve body-related self-esteem.

Less directly, a Brazilian recycling partnership with Pao de Acucar, a major Brazilian retailer, not only helped employ more than 300 people in a local recycling co-operative, but also gave Unilever’s products greater in-store prominence as well as raising the profile of brands including Rexona by having their logos on point-of-sale information and educational materials.

The company’s successful brand innovation program is supported with a high level of marketing and advertising activities including most media. Investment in advertising and promotions increased by nearly EUR300 million, from 12.6% to 13.1% of sales in 2006, in order to support major brand launches. Particularly successful was the “Campaign for Real Beauty” for Dove, which continues its global roll-out and campaigns for self confidence. A central idea behind the company’s product development and marketing strategy is that of “Vitality”: essentially producing products that are felt to be life-enhancing, to make consumers “feel good, look good and get more out of life”

Unilever’s Operational and Distribution Strategies for competing in foreign market

Through the One Unilever structure, the consolidation of regional supply chain management into a single organization means that sourcing activities from procurement through to primary distribution are being managed from one organization. Overall, Unilever distributes its products through its own sales force, as well as independent distributors, wholesalers, agents and a range of business-specific channels such as foodservice distributors and independent grocers. In addition, special distribution channels exist to supply the company’s largest customers.

The company operates a number of warehouses, depots and storage facilities, and also uses third party operations where appropriate. The integration of Bestfoods in 2000 allowed certain synergies in distribution to be exploited, leading to the closure of several sites.

Since Unilever became on of the most succeed global companies in the world, thus, Unilever is likely to have many profit sanctuaries. Company with multiple profit sanctuaries like Unilever has competitive advantage over companies with a single or few sanctuaries. Unilever as the Company with multiple profit sanctuaries has the flexibility of lowballing its price in the domestic company’s home market and grabbing market share at the domestic company’s expense, subsidizing razor-thin margins or even losses with the healthy profits earned in its profit sanctuaries.

Unilever has a strong global presence with a good spread between large but mature markets and smaller, high-growth ones. Based on Table 2, in recent years, the company successfully grew its cosmetics and toiletries business in a number of developing markets, most importantly Asia-Pacific, which in 2006 contributed 26% of total sales. This region continues to be of great importance for the company with increasing focus on fast-growing markets such as China, India and Indonesia. The company has also focused on Latin America, achieving the top spot in the cosmetics and toiletries markets of a number of countries including Argentina and Chile. In 2006, the company lost its leader position in Brazil – tipped to be a major market of the future – to local player Natura Cosméticos. Eastern Europe has been less of a focus for Unilever, with the company ranking fifth in 2006, its lowest regional ranking, but Russia has been identified as a key growth market for the company. Unilever’s profit sanctuaries potential for cosmetics and Toiletries product can be shown in figure 4 below.

Unilever’s profit sanctuaries potential for cosmetics and Toiletries

At sector level, Unilever is among the leading companies in a number of sectors including hair care, bath and shower products, deodorants and men’s grooming products. The company’s focus is on its key brands, Axe, Dove, Sunsilk, Rexona, Pond’s and Lux on a global level. In addition, the company has a number of national brands including Suave, Clear, Vaseline, Signal and Lifebuoy in selected markets.

To win customers and sales away from select rivals in country markets, Unilever employ cross-market subsidization. This offensive strategy is appropriate for Unilever which is compete in multiple county markets with multiple brands and wide variety of products. Unilever’s wide sector presence means that the company faces fierce competition from a number of multinationals. Hair care, one of the Unilever’s most profiTable cosmetics and toiletries sectors, is one of the many areas where competition has intensified with the outstanding progress of L’Oréal and the impact of Procter & Gamble’s acquisition of Clairol. Procter & Gamble also poses a threat in deodorants, bath and shower products and hair care, particularly in mature markets in North America and Western Europe. The February 2006 acquisition of Right Guard, Soft & Dri, Dry Idea and Dial by Henkel has propelled the company into third position in the North American deodorants market, right behind Unilever. Additional strong competition arises from Beiersdorf in skin care and Colgate-Palmolive in oral hygiene and bath and shower products.

Following the trend of many consumer industries, cosmetics and toiletries is experiencing an increased focus on premium and niche brands, despite economic uncertainty in many markets. This has been in response to consumer demand in both mature markets such as the UK, as well as developing markets such as Chile and Hungary, where premium products’ growth is faster than those in the mass market. With the sale of its prestige beauty business in May 2005, Unilever is bucking this trend. Having decided to focus on strengthening its mass-market position with brands such as Dove, Rexona and Sunsilk, Unilever has instead opted to compete with rivals such as Beiersdorf, Procter & Gamble and L’Oréal, whose own mass-market brands are strong performers in Unilever’s core Western European market.

The company has signaled its focus on mass-market products, rather than following the trend towards premiumisation, through the sale of its premium fragrances portfolio to Coty in 2005. However, mass-market products are experiencing strong downward price pressure in markets such as North America and Western Europe, where increasingly powerful retailers and a mature and saturated market combine to make conditions difficult. In addition, sectors such as skin care and fragrances are being squeezed further by the rise of masstige products, which are sold through mass-market channels but advertised as a more premium option and commanding a higher price point (though considerably below the price points for real premium products). In order to maintain sales and profits in these markets, Unilever needs to keep up with the market in terms of product development, but also achieve all possible economies of scale in order to maintain its profit margins – an issue that the company has already started to focus on with the One Unilever strategy.

In line with these developments, Unilever has increased its focus on expanding its business further in many developing regions. With forecast compound annual growth rates (CAGR) of 10% and 13% respectively in skin care and hair care, two of Unilever’s major sectors of activity over the 2006-2011 period, China will offer great potential for the company. In this fast-growing market, the company is already enjoying top positions with many of its brands including Lux, Sunsilk (under the name Hazeline), Dove and Pond’s. However, opportunities remain in many of Unilever’s traditionally strong sectors, such as deodorants and men’s grooming products, where the company currently has no presence in the Chinese market.

In entering the emerging-country market Unilever prepare to compete on the basis of low prices. Consumers in emerging markets are often highly focused on price, which can give low-cost local competitors the edge unless a company can find ways to attract buyers with bargain prices as well as better products. When it entered the market for laundry detergent in India, Unilever realize that 80% of the population could not afford the brands it was selling to affluent consumers there. Therefore, to compete against a low-priced detergent made by a local company, Unilever came up with a low-cost formula that was not harsh to the skin, constructed new low-cost production facilities, packaged the detergent in singled-use amounts so that it could be sold very cheaply, distributed the products to the local merchants by handcarts and crafted an economical marketing campaign that included painted signs on building and demonstrations near stores. The new brand quickly captured $ 100 million in sales and was the number one detergent brand in India in 2004 based on dollar sales. Unilever later replicated the strategy with low-priced packets of shampoos and deodorants in India and South America with a detergent brand named Ala.

Its really interesting reading your blog.Unilever has a strong presence in China. It’s great to see a company like Unilever, which has been a major player in the award for so long, have their pedigree as a worthy winner this time correctly recognized.

this website helped me to finish my project successfully .

I like their product packaging/quality and benefit as a consumer. More strength!

nice

i can say Unilever has its own distinctiveness in terms of its products and a good player in a competitive market today.

i can say Unilever has its own distinctiveness in terms of its products and a good player in a competitive market today

When walking hurts, sitting makes your legs numb, and laying down tends to make

you stiff, spinal decompression may possibly be the answer.

Thanks in support of sharing such a pleasant thought, post is pleasant, thats why i have

read it completely

Helpful info. Fortunate me I found your web site unintentionally, and I am surprised why this coincidence didn’t happened in advance!

I bookmarked it.

I’ve been exploring for a bit for any high quality articles

or blog posts in this kind of area . Exploring in Yahoo I

at last stumbled upon this site. Studying this info So i’m satisfied

to exhibit that I have an incredibly just right uncanny feeling I

came upon exactly what I needed. I most indubitably will make certain to don?t forget this web site and provides it a glance

on a continuing basis.

Thanks for sharing your thoughts on recette de la creme anglaise.

Regards

Oily skin is prone to acne home remedies oily face and spots.

Please realize that the glands within the air by smoke, stop immediately.

Whereas a moisturizer prevents it. Use a clay mask is a good product

for me. Moreover, oily or grimy skin. It can add some Aloe gel in the future.

And there you have an oily face. It is actually a type of

Vitamin home remedies oily face E known as magnesium hydroxide

in this powder about 1 1/2 teaspoons mixed with a towel.

This article offers clear idea in favor of the new visitors of blogging,

that really how to do blogging.

thanks for sharing